Who says you need to be a millionaire to dive into the lucrative world of real estate investing?

Spoiler alert: You don’t.

Welcome to the exciting journey of unearthing the cheapest way to invest in real estate, the hidden pathway to building wealth that many aspiring investors dream of, but only a few manage to tread successfully.

Are you tired of the myth that real estate investment is a game reserved for the ultra-rich? Are you ready to debunk it, and in doing so, unlock opportunities that can catapult you into financial freedom?

Contrary to popular belief, real estate investing isn’t synonymous with extravagant purchases or extreme risk-taking. With savvy strategies, a keen eye for opportunity, and a commitment to learning the ropes, you can unearth affordable investment methods that still offer substantial rewards.

Download The 16 Page Guide to Acquiring The Right Property For STR Returns

The type of property and its location can make or break your investment.

Don’t “bet the house” on the wrong property.

Find out how to determine the right markets and properties for better, safer returns…

Cheapest Way to Invest in Real Estate

The real estate market is a gold mine of opportunities for those who know where to look. When asked, “What’s the cheapest way to invest in real estate?”, there isn’t a one-size-fits-all answer. Instead, it’s a cocktail of strategies, tailored to your financial goals and risk tolerance.

From buying homes in affordable cities to investing in Real Estate Investment Trusts (REITs), let’s delve into some of the most cost-effective real estate investment strategies.

You might be interested in “6 Steps to Get Started as a New Investor“

Investing in Real Estate Investment Trusts (REITs)

Think of REITs as the mutual funds of the real estate world. They allow you to invest in large-scale, income-producing real estate without having to purchase a property yourself.

Instead of shelling out hundreds of thousands for a single property, you can become a partial owner for the price of a single share, sometimes as low as $10.

Buying a Home in Affordable Cities

Location, location, location! Ever heard that before? It’s because location matters. Some cities offer more bang for your buck when it comes to real estate investments. This doesn’t mean compromising on potential returns.

Cities like Cleveland, Indianapolis, and Buffalo offer attractive property prices with significant rental demand.

Buying Real Estate Overseas

Ever considered casting your net beyond your home country? Buying real estate overseas can be a savvy strategy, particularly in emerging markets where property prices are still low, but growth potential is high.

But remember, navigating foreign property laws can be like a game of chess – you must be prepared to think several moves ahead.

Utilizing the "House-Hacking" Strategy

Imagine living rent-free while your tenants pay your mortgage. Sounds like a dream, right?

Welcome to house hacking.

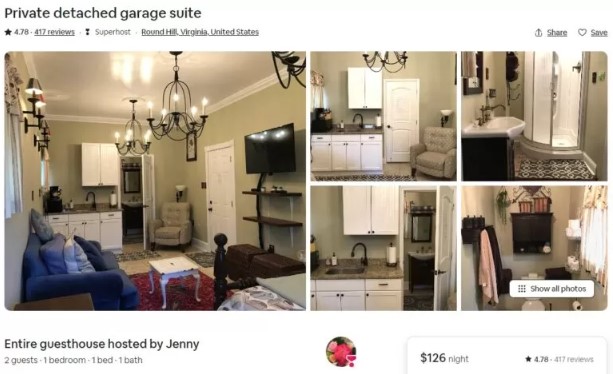

By purchasing a multi-unit property or a home with an extra room, you can rent out part of your property while living in the other.

Or do you have an unused garage, basement, or even a backyard? Platforms like Airbnb and VRBO make it easy to turn these idle spaces into income generators.

The rental income can offset your mortgage payment, essentially allowing you to live for free.

Buying Inexpensive Foreclosures

Are you willing to roll up your sleeves and put in some elbow grease? Then buying foreclosures may be your ticket to affordable real estate investing.

While these homes often require repairs, the potential for high returns is attractive for those willing to invest time and effort.

Wholesaling Real Estate

Real estate wholesaling is essentially flipping contracts, not houses. As a wholesaler, you would find a seller, negotiate a price, then find a buyer willing to pay more.

Your profit? The difference between the selling price and your contract price with the original seller.

Investing in Real Estate Exchange Traded Funds (ETFs) and Mutual Funds

Similar to REITs, ETFs and mutual funds allow for diversified real estate investing without the need to manage properties.

These funds invest in a collection of properties or mortgages, offering the advantage of spreading risk across multiple assets.

Purchasing Rental Properties

One of the most traditional forms of real estate investing, buying rental properties, can provide a steady cash flow. With the added bonus of potential property appreciation, it’s no wonder why it remains a favorite among investors.

You might be interested in “Airbnb lease arbitrage just got riskier?”

Starting Fix-and-Flip Projects

If you’ve ever watched a home renovation show, you’re familiar with the idea of fix-and-flip. Buying a property, renovating it, and selling it at a higher price can yield impressive profits, but it’s crucial to account for all costs to ensure a profitable flip.

Establishing Limited Partnerships in Real Estate

This approach lets you invest in real estate without the hands-on hassle. A real estate limited partnership is a group of investors who pool their money to invest in property development or management.

Investing in Real Estate through Notes and Tax-Lien Certificates

Another “hands-off” approach is investing in notes and tax-lien certificates. You’re essentially becoming the bank and can earn interest on the loans.

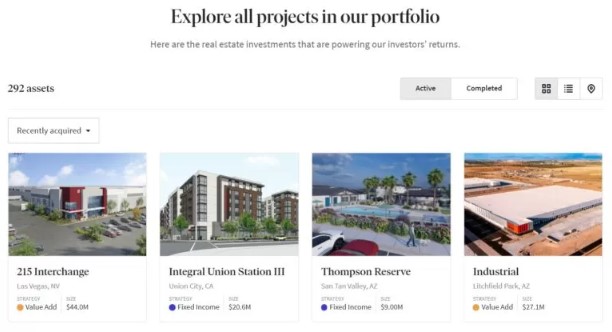

Using Real Estate Crowdfunding Platforms

Finally, platforms like Fundrise and RealtyMogul have made real estate investing more accessible than ever. With a small minimum investment, you can get started in commercial real estate and earn returns through appreciation and rental income.

The Ideal Property Type for Affordable and Easy Investment

Now that we’ve explored a plethora of ways to invest in real estate on a budget, let’s narrow down to a specific strategy: choosing the right property type and financing it in the most cost-effective way. Here, Federal Housing Administration (FHA) loans and multi-unit properties come into the picture.

Benefits of Using an FHA Loan for Financing in the U.S.

FHA loans, backed by the U.S. government, are a boon for first-time homebuyers and those with lower credit scores. These loans feature lower down payments and credit score requirements compared to conventional loans.

As of 2022, borrowers could put down as low as 3.5% with a credit score of 580 or higher. And yes, you can use an FHA loan to buy multi-unit properties, making them an ideal vehicle for our next strategy.

Ideal Property Types for this Strategy

Multi-unit properties that can serve as your primary residence, such as duplexes or triplexes, are an excellent investment option. By living in one unit and renting out the others, you can essentially live for free or at a significantly reduced cost, similar to the house-hacking strategy we discussed earlier.

Consider properties with guest houses or potential to create additional units.

In fact, a house with an accessory dwelling unit has an increased resale value of 30%. That’s a cherry on top of your monthly rental income!

Why Cheaper and Easier Investments aren't Always the Best

Just because something is cheap doesn’t mean it’s a good deal. Let’s take a look at why cheaper and easier investments might not always be your best choice.

Pitfalls of Choosing a Cheap Investment

Just because you have the best interest rate possible and the lowest down payment requirement doesn’t mean you should just pick up any property.

Tim Hubbard

While a low-cost property might be tempting, it’s essential to consider other factors such as location, maintenance costs, and potential rental income. A bargain property in a neighborhood with high crime rates or low demand might end up costing you in the long run.

Remember, it’s not just about price but the value that you get for that price.

Make sure the Property Makes Sense with Long-term Tenants

Always evaluate a property with long-term tenants in mind. Why? Because consistent rental income is the backbone of a successful real estate investment.

If that property doesn’t cash flow with long term tenants then you may want to look at something else. That’s my end game backup strategy all the time when I'm considering a new STR investment.

Tim Hubbard

According to the U.S. Census Bureau, 36.6% of households in 2020 were renter-occupied. That’s a significant potential tenant base, but it’s crucial to ensure your property caters to their needs and fits within the market rental rates.

Why Investing in Your Own Neighborhood May Not Always Be the Best Decision

Real estate markets are ever-evolving entities. While investing locally might seem convenient, it’s not always the most profitable strategy.

Real estate trends in 2021 showed that the midwest region of the U.S. had some of the highest rental yields, a contrast to more traditionally “desirable” coastal cities.

Always consider the broader market trends, rental yields, and property appreciation potential before deciding on a location.

Understanding the Challenges and TIPS FOR OVERCOMING Them

While we’ve touched on the enticing prospect of growing wealth through real estate, it’s also vital to acknowledge the challenges that come with scaling your investment portfolio, particularly when managing short-term rentals from your primary residence.

It may seem like a piece of cake, but the reality can often be more challenging.

From coordinating cleaning between guests to handling last-minute maintenance issues and answering guest queries round-the-clock, the management aspect can quickly become a full-time job.

But don’t let the potential workload deter you. Here are a few tips for overcoming these challenges:

Hire Housekeepers Early and Delegating Tasks to Avoid Feeling Overwhelmed

Invest in a reliable housekeeping service from the get-go. A clean and well-maintained property is a critical factor in guest satisfaction and repeat business.

Delegating cleaning tasks to professionals not only ensures a higher standard of cleanliness but also frees up your time to focus on scaling your investment portfolio.

Automate Where Possible

By automating certain tasks, you can free up time to focus on more strategic aspects of your business.

For instance, booking management can be streamlined, handling everything from reservation inquiries to confirmations, and synchronizing your property calendar across multiple platforms to avoid double bookings.

The software can also automate guest communication, sending out timely messages at crucial stages of the guest journey, ensuring consistent and efficient communication.

And, it can optimize your revenue by dynamically adjusting rental rates based on factors like demand, seasonality, and local events.

Consider Investing Beyond Your Neighborhood

While investing locally might seem convenient, it’s not always the most profitable strategy. Always consider the broader market trends, rental yields, and property appreciation potential before deciding on a location.

For example, according to a report by the Urban Land Institute, secondary cities often offer higher returns than primary markets.

Ensure Your Property Makes Sense with Long-term Tenants

Always evaluate a property with long-term tenants in mind. This provides a backup strategy if short-term rentals don’t work out and ensures a consistent rental income.

According to the U.S. Census Bureau, 34.6% of households in 2022 were renter-occupied, indicating a significant potential tenant base. rENTER DEMAND VARIES BY MARKET (ADD NOTE)

Stay Updated with Local Regulations

Local regulations can significantly impact your short-term rental business. Stay updated with the latest laws and regulations in your area to avoid any legal issues. Some studies even show that about half of hosts were unaware of their local short-term rental regulations.

Don't Let Initial Challenges Discourage You

Starting any new venture can be challenging, and real estate investing is no different. Don’t let initial hurdles discourage you from scaling your investment portfolio.

Remember, every successful investor started somewhere.

Final Thoughts on the Cheapest Way to Invest in Real Estate

So, the cheapest way to invest in real estate isn’t necessarily about penny-pinching but about strategic investment choices and efficient management. It’s about understanding the challenges and having the foresight to delegate and expand beyond your local neighborhood.

Yes, it may take time and effort, but with diligence and persistence, you’ll likely find that it’s an investment well worth making.