Ever thought about waking up to the gentle lull of waves on a pristine beach or the serene chirping of birds in a lush countryside? Well, buying a property overseas isn’t just about that dreamy escape. It’s a strategic move, a golden ticket to diversifying your investment portfolio.

And guess what? It’s not as complicated as it sounds.

Why You Should Seriously Consider Buying a Property Overseas

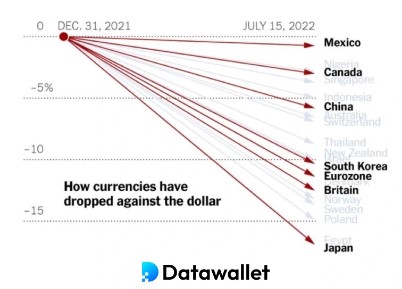

If you’re still on the fence about investing in international real estate, let’s talk numbers and opportunities. With stronger currencies like the U.S. dollar, you have the leverage to invest in countries where the currency is weaker. This not only gives you more bang for your buck but also opens doors to markets you might not have considered before.

Worried about securing a loan in a foreign country? Don’t be. Many of us already have a significant amount of equity in our domestic properties. This means you could opt for a cash-out refinance and use that capital to fund your overseas investment.

Brent Johnson’s Milkshake Theory

Navigating the intricacies of global finance can sometimes feel like deciphering a cryptic code. But every so often, a theory like Brent Johnson’s Milkshake Theory emerges, offering a lucid lens to view the world’s economic dance.

Imagine the global economy as a vast milkshake, with each nation acting as a straw, drawing capital. Johnson’s theory posits that as the U.S. flexes its economic muscles, especially with rising interest rates, it’s set to absorb a lion’s share of this capital, much like the biggest straw taking the most from the milkshake. This massive intake can unsettle other markets, creating ripples that can be felt worldwide.

But how does this tie into the intricate world of overseas real estate? The connection is profound.

As capital flows shift, influenced by titans like the U.S., property values in various countries can waver. Drawing from my time in places like Colombia, a valuable U.S. dollar can make properties in such regions very affordable.

For the astute investor, this presents a golden window of opportunity. When property values in certain regions dip due to these global economic shifts, it’s similar to spotting prime real estate locations, reminiscent of the coveted Boardwalk in Monopoly, available at a fraction of the cost.

Exchange Rate Arbitrage and its Huge Potential for Investors

Exchange rate arbitrage is a compelling strategy in the realm of overseas property investment, often overlooked by many but recognized by seasoned investors as a golden opportunity. At its core, it’s about capitalizing on the fluctuations of currency values in the global market.

Imagine this scenario: You buy a property in a country when its currency is at a historical low against the dollar. Over time, as economic tides shift and that currency strengthens, the value of your property in dollar terms increases significantly. Now, when you sell or rent out that property, the returns are amplified by the strengthened currency.

The result? A profit margin that’s considerably higher than what you’d get from property appreciation alone.

From my experiences, particularly in places like Colombia, I’ve seen firsthand how currency dynamics can create lucrative opportunities. The Colombian Peso, for instance, has seen significant fluctuations against the US dollar over the years.

Such shifts can make properties in cities like Medellin much more affordable for investors holding strong currencies. It’s all about understanding the local market, the potential for currency appreciation, and having an exit strategy to capitalize on these shifts.

However, it’s essential to approach exchange rate arbitrage with a well-informed perspective. While the potential for profit is significant, so are the risks. Currency markets can be unpredictable, influenced by a myriad of factors from geopolitical events to macroeconomic policies.

Seasoned investors often combine this strategy with other risk-mitigation tactics, ensuring they’re not solely relying on currency appreciation. They’ll look at:

- the property’s intrinsic value

- the potential for rental income

- the overall economic health of the country

In essence, exchange rate arbitrage is a powerful tool in the investor’s toolkit, but like all tools, it’s most effective when used wisely, with a deep understanding of both the local and global economic landscapes.

Download The 16 Page Guide to Acquiring The Right Property For STR Returns

The type of property and its location can make or break your investment.

Don’t “bet the house” on the wrong property.

Find out how to determine the right markets and properties for better, safer returns…

The Importance of Having a Plan B

Life’s unpredictable. Economic downturns, political unrest, or even personal reasons might make living in your home country challenging. Buying a property overseas is more than an investment; it’s a safety net. It’s your plan B. A retreat or even a new beginning in a land that offers stability, growth, or just a fresh perspective.

So, why should you consider a Plan B?

1. Economic stability

The global economy is akin to a set of dominoes. A financial crisis in one country can send ripples across the globe. By diversifying your investments and owning property in a stable economy, you hedge against potential economic downturns in your home country.

2. Political safety

Political landscapes can change overnight. From sudden policy shifts to civil unrest, your home country might not always be the safest place to live. Owning property in a politically stable country can provide a safe haven during turbulent times.

3. Personal growth

Sometimes, the need for a Plan B is not driven by external factors but by an inner calling. A desire to experience new cultures, lifestyles, or simply to break the monotony of the familiar. An overseas property can be that gateway to personal evolution.

Crafting Your Plan B: Things to Consider

Before you take the leap, let’s see the key things you’ll want to consider for your ‘Plan B’.

Research is key

Don't just jump onto the overseas property bandwagon. Research potential countries thoroughly. Look into their political stability, economic growth, property laws, and cultural nuances.

Legal framework

Every country has its own set of property laws. Some might be welcoming to foreign investors, while others might have stringent regulations. It's crucial to understand these laws to avoid potential pitfalls.

Financial implications

Beyond the property's cost, consider other financial aspects like maintenance, taxes, and potential rental income. Also, be aware of currency exchange rates and their fluctuations.

Cultural adaptability

If your Plan B involves moving to this new country, consider the cultural shift. Can you adapt to the new lifestyle, language, and customs?

Local connections

Building local connections can be invaluable. Whether it's a trustworthy real estate agent, a local friend, or joining expat communities, these connections can offer insights that no guidebook or online forum can.

Exit strategy

Just as you plan your entry, plan your exit. If circumstances change and you need to sell your property, what's the process? How easy is it to liquidate your investment?

Interested in learning more about creating a Plan B? Check out this episode on the Expat Money Show.

My Experience with Foreign Real Estate

Navigating the world of foreign real estate has been a roller-coaster of experiences for me. From the sambas of Brazil to the bustling streets of Colombia, each place has offered a unique blend of challenges and rewards.

But beyond the allure of new horizons, it’s about understanding local markets, forging genuine connections, and sometimes, trusting my gut that has truly defined my journey.

I’ve spent a significant portion of the last six years between Brazil and Colombia, not just as a tourist, but as an investor and observer.

In Brazil, I was struck by the nation’s self-reliance. They have a wealth of their own commodities, making them less dependent on the US dollar. This intrinsic strength in their economy presented a different kind of investment landscape, one that required understanding the local dynamics and not just global economic trends.

Colombia, on the other hand, was a lesson in currency dynamics. Places like Medellin taught me how shifts in currency can unveil lucrative opportunities. I recall looking at property prices in Medellin and realizing that, thanks to the strong US dollar, real estate was much more affordable for someone like me. But it wasn’t just about capitalizing on currency fluctuations. It was about understanding the local culture, the pace of life, and the aspirations of the people.

But, as with any venture, there were challenges.

I remember the intricacies of local regulations, the cultural nuances that played a pivotal role during negotiations, and the importance of building trust with local partners. There were times I felt out of depth, like trying to catch the rhythm of a song I’d never heard before.

But those moments of uncertainty were balanced by the thrill of finalizing a deal, the pride of owning a piece of a new world, and the stories and friendships forged along the way.

Potential Options for Investors Considering Buying Real Estate Abroad

So, where should you invest? Tropical Thailand, beautiful Brazil, or historic Greece? Each has its charm and potential. For beach lovers and those looking for affordability, Southeast Asia is a paradise. For history buffs and wine lovers, Europe offers a mix of culture and steady returns. Let’s take a look at some of the options.

Brazil: The Land of Samba and Opportunities

Why Brazil?

Brazil, with its vast landscapes, diverse culture, and booming economy, offers a plethora of opportunities for real estate investors. From the bustling streets of Rio de Janeiro to the serene beaches of Bahia, Brazil is a land of contrasts and potential.

- Economic resilience

Brazil’s self-sufficiency and rich reserve of commodities make it less dependent on the US dollar, offering stability to investors.

- Tourism and culture

With iconic events like Carnival and its world-famous beaches, Brazil has a thriving tourism sector, ensuring a steady demand for short-term rentals.

- Diverse investment options

Whether it’s urban apartments in São Paulo or beachfront villas in Florianópolis, Brazil offers a range of properties to fit every investor’s budget and preference.

Check out the property I bought in Florianópolis, Brazil.

Colombia: A Rising Star in South America

Why Colombia?

Colombia, once known for its turbulent past, has emerged as a beacon of growth and opportunity in South America. Cities like Medellin and Bogota are becoming hubs of innovation, culture, and real estate potential.

- Currency opportunities

With the Colombian Peso’s fluctuations against the US dollar, savvy investors can capitalize on favorable exchange rates to secure properties at competitive prices.

- Urban growth

Cities like Medellin have seen significant urban development, with increasing demand for modern apartments and commercial spaces.

- Tourism Boom

Colombia’s rich culture, history, and natural beauty are attracting tourists from around the world, creating a demand for short-term rental properties.

Portugal: A Blend of History and Modernity

Why Portugal?

Portugal, with its rich maritime history, stunning coastline, and vibrant cities, is fast becoming a hotspot for international real estate investors. From the historic charm of Lisbon to the beach resorts of the Algarve, Portugal offers a diverse range of investment opportunities.

- Golden Visa program

Portugal’s residency-by-investment program allows non-EU investors to gain a residency permit by investing in real estate, making it an attractive proposition for many.

- Cultural and historical appeal

With UNESCO World Heritage sites, medieval towns, and a rich seafaring history, Portugal offers a unique blend of the old and the new.

- Thriving tourism

Portugal’s diverse landscapes, from its beaches to its wine regions, attract tourists year-round, ensuring a steady demand for short-term rentals.

Mexico: A Mosaic of Cultures and Landscapes

Why Mexico?

Mexico, known for its vibrant culture, diverse landscapes, and rich history, offers a plethora of real estate opportunities. From the bustling streets of Mexico City to the serene beaches of Cancun, Mexico is a land of contrasts and potential.

- Affordability

Compared to many Western markets, Mexico offers attractive property prices, allowing investors to get more value for their money.

- Diverse investment options

Whether it’s a colonial home in Oaxaca, a beachfront condo in Playa del Carmen, or an urban apartment in Monterrey, Mexico caters to a wide range of investor preferences.

- Strong rental market

Popular tourist destinations like Tulum, Puerto Vallarta, and Cabo San Lucas ensure a robust demand for short-term rentals.

Greece: Where Ancient Mythology Meets Modern Living

Why Greece?

Greece, the cradle of Western civilization, offers a unique blend of ancient history and contemporary amenities. Its diverse landscape, from the islands of Santorini and Mykonos to the historic streets of Athens, provides varied investment opportunities.

- Cultural richness

Owning property in Greece is akin to having a front-row seat to history. The country is dotted with ancient ruins, iconic landmarks, and offers a deep dive into mythology and philosophy.

- Golden Visa program

Much like Portugal, Greece offers a residency-by-investment program, allowing non-EU investors to gain a residency permit through real estate investment.

- Emerging from economic crisis

After a prolonged economic downturn, Greece’s property market is showing signs of recovery, making it a potential goldmine for early investors.

Thailand: A Slice of Paradise

Why Thailand?

Thailand, with its pristine beaches, lush landscapes, and rich culture, has long been a magnet for tourists. But beyond its natural beauty, it offers a robust real estate market that caters to various budgets.

- Affordability

Compared to Western markets, you can get more bang for your buck in Thailand. Whether it’s a condo overlooking the Andaman Sea or a villa nestled in the hills of Chiang Mai, there’s something for every pocket.

- Tourism potential

With tourist hotspots like Phuket, Koh Samui, and Bangkok, there’s a continuous demand for short-term rentals, ensuring a steady income stream for property owners.

- Expat-friendly policies

Thailand offers various visa options for retirees, investors, and entrepreneurs, making it easier for foreigners to settle and invest.

You might be interested in “Buying an Airbnb: Luxury VS Exotic VS Affordable“

Leveraging Virtual Assistants

In today’s digital age, you don’t need to hop on a plane every time there’s paperwork to be done or a property to be inspected. Virtual assistants have revolutionized the way we manage overseas properties. From handling legalities to giving you a virtual tour, these professionals ensure your investment is in safe hands, even from thousands of miles away.

What If You Could Borrow My Team 24/7?

I’ve done the hard work so you don’t have to…

You no longer have to pay more than you need to to manage your short-term rentals.

I’ve spent years hiring, training and building up a 24/7 team of Guest Experience Agents for my short term rental business

I’m only accepting a select handful of management partners right now, so if you’re interested in borrowing my team, click the button and let’s chat!

What to Take Into Consideration when Buying Foreign Properties

It’s not just about the money. It’s about understanding local customs, laws, and even the weather. Always do thorough research or partner with local experts. Consider factors like political stability, property rights, and potential rental yields. And remember, sometimes the best properties aren’t on the main streets but hidden gems waiting to be discovered.

Here’s a comprehensive guide to help you navigate the intricacies of buying property abroad.

Understand Local Customs and Etiquette

Every country has its unique set of customs and traditions. In some cultures, aggressive negotiation might be seen as rude, while in others, it’s the norm. Before diving into property discussions, familiarize yourself with local etiquette. This not only ensures smoother transactions but also helps in building lasting relationships with locals, which can be invaluable in the long run.

Dive Deep into Local Laws

Property laws can vary drastically from one country to another. Some nations might have restrictions on foreigners owning land, while others might offer tax incentives to attract international investors.

- Ownership Structure: In some countries, foreigners cannot directly own land but can lease it or own through a local entity.

- Tax Implications: Be aware of property taxes, capital gains tax, and inheritance laws. It’s also crucial to understand any tax obligations in your home country related to foreign property ownership.

Weather and Climate

While a beachfront property in the Caribbean sounds dreamy, consider factors like hurricane seasons or potential flooding. Similarly, a quaint cottage in Europe might come with harsh winters. Understanding the local climate will help you prepare for maintenance costs and ensure the property is suitable for your intended use, be it vacationing, renting out, or permanent residency.

Political and Economic Stability

A country’s political and economic landscape can significantly impact property values. Research the nation’s political history, upcoming elections, and economic indicators. A stable environment is more likely to ensure steady appreciation of your property value and safeguard your investment.

Potential Rental Yields

If you’re considering renting out your property, research the local rental market. Factors like tourist seasons, local festivals, or business conventions can influence rental demand. Also, consider local competition, average rental prices, and occupancy rates to gauge potential returns.

Hidden Gems vs. Popular Spots

While main streets and popular tourist spots might seem like the obvious choice, sometimes the real treasures lie off the beaten path. Exploring lesser-known areas can lead you to properties with lower prices but high potential. Engage with local communities, visit local cafes, and take leisurely walks to discover areas that might not be on every investor’s radar.

Partner with Local Experts

Having a local ally can be a game-changer. Whether it’s a real estate agent, a lawyer, or just a local friend, they can provide insights that online research might miss. They can guide you on fair pricing, potential pitfalls, and even introduce you to sellers before properties hit the market.

Listen to this podcast episode on “Tips You Need To Know When Buying International Property“.

Frequently Asked Questions

Local property laws can dictate who can buy property, the types of property that can be purchased, and the rights of the property owner. Some countries may restrict foreign ownership, while others might require partnerships with local entities. It’s essential to understand these laws to ensure a smooth transaction and secure your investment.

When buying property overseas, you’ll need to consider property taxes in that country, potential capital gains tax upon selling, and inheritance taxes. Additionally, your home country might tax global income or gains, so it’s crucial to understand both domestic and foreign tax obligations.

Political stability can influence property values, rental income potential, and the ease of doing business. A politically unstable country might pose risks like abrupt changes in property laws, expropriation, or civil unrest. It’s always wise to assess the political climate before investing.

Start by seeking recommendations from fellow investors or expats who’ve bought property in the same region. Online expat forums, international real estate platforms, and local real estate associations can also be valuable resources. Always vet professionals thoroughly and ensure they have a good track record.

Yes, the best type of property can vary by country based on factors like tourism appeal, urbanization trends, and local preferences. For instance, beachfront properties might be lucrative in tropical countries, while city apartments could be in demand in rapidly urbanizing areas.

In my experience unless you’re earning income in the foreign country where you’re planning to purchase real estate, and unless you have been filing taxes for multiple years, then it’s very unlikely the bank will give you a loan. Always research local banking and lending practices before committing.

Understanding local customs can aid in negotiations and relationship-building. This includes knowing the cultural norms around bargaining, property viewing etiquette, and gift-giving. Additionally, being aware of local festivals, holidays, and traditions can provide insights into the best times to conduct business.

Currency fluctuations can affect the value of your investment and returns. Consider using hedging strategies, or opening local bank accounts to manage rental income.

Yes, global events, economic shifts, and international policies can influence real estate markets. Stay updated with global news, join international real estate forums, and consider subscribing to global property market reports to stay informed.

Absolutely! Renting out can provide an income stream. Consider factors like local rental laws, peak tourist seasons, property management options, and local tax implications on rental income. It’s also essential to ensure your property is adequately insured and maintained in your absence.