As of 2022, there were over 4 million Airbnb hosts worldwide. That’s a staggering number, isn’t it? But what’s even more captivating is the diversity in their offerings – from lavish villas to quaint cottages, the world of Airbnb is as varied as it is vast.

This platform has revolutionized the way people travel, offering a unique blend of comfort, affordability, and local experience that traditional accommodations often lack. As a result, buying an Airbnb property has become an attractive proposition for many.

But is it the right move for you?

Whether you’re considering a luxury villa that promises high returns or a budget-friendly home that offers steady income, the numbers speak for themselves – the Airbnb market is ripe for investment.

But remember, the devil is in the details, and that’s where our guide comes in. We’ll help you sift through the noise, understand the trends, and make an informed decision.

Is buying an Airbnb Still a Good idea in 2023?

In 2023, the Airbnb landscape is a complex and multifaceted arena.

Despite the company’s record revenue of $2.9 billion in the third quarter of 2022 and a 46 percent surge in profits, hosts and guests alike are voicing concerns that cannot be ignored.

For some hosts in desirable locations, the sudden drop in bookings over the summer months has been a startling wake-up call. Market saturation, with a 29 percent increase in U.S. listings on Airbnb, has led to a decrease in occupancy rates, spreading bookings thin across more listings.

The Airbnbust is upon us#Airbnb pic.twitter.com/2BMTjGhiox

— Amy Nixon (@texasrunnerDFW) October 16, 2022

Guests, too, are expressing discontent. High prices, steep cleaning fees, and inconsistent standards have led some travelers to reconsider Airbnb as a go-to option.

The onset of soaring cleaning fees and the lack of service in stark contrast to hotels have caused a shift in preference.

The market’s dynamics are shifting, and hosts must adapt to stay competitive. One host who’s been active since 2018 points to market saturation as a significant contributor to lower occupancy. Industry experts forecast a continued decline in occupancy into the next year, emphasizing that hosts will have to compete more for guests.

Yet, the overall picture is not entirely bleak.

Despite individual host complaints, overall bookings continue to grow, and the company enjoys a banner year. Airbnb’s CEO acknowledges the need for improvement in transparency and is taking steps to address unreasonable requests and exorbitant fees.

Is Buying an Airbnb a Good Investment?

It’s a question that many potential investors in the real estate market ponder. Short-term rental properties, like Airbnb, offer an appealing opportunity to generate income from vacation rentals and attract a global audience of travelers.

The potential for profitability in this industry is significant, with short-term rentals reported to generate up to three times more rental income compared to traditional long-term rentals.

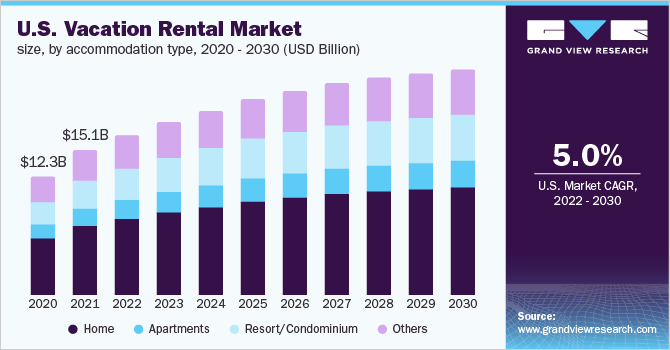

This higher income potential is due to the ability to charge premium rates for short stays, particularly in popular tourist destinations or during peak seasons. The vacation rental market itself is experiencing remarkable growth and is projected to reach $119 billion by 2030.

Travelers nowadays seek unique experiences and personalized accommodations rather than traditional hotels, which has contributed to the increasing popularity of vacation rentals. This changing trend in travel preferences presents an excellent opportunity for investors interested in buying an Airbnb property.

One of the significant advantages of buying an Airbnb property is the flexibility it offers to hosts. As an Airbnb host, you have the freedom to rent out your property on your own terms.

You can set your own rental rates, manage availability based on your preferences, and tailor your property listing to attract your target guests. This level of control allows hosts to adapt to market conditions, maximize occupancy rates, and optimize their rental income.

However, it’s important to note that the success of an Airbnb investment relies on various factors.

Location plays a crucial role in determining the demand and profitability of your property. Choosing a desirable location with high tourist traffic or proximity to popular attractions can significantly impact your rental income potential. Thorough market research is essential to identify areas with strong demand and growth prospects.

Understanding local regulations and compliance requirements is another crucial aspect of buying an Airbnb property. Different cities and regions may have specific laws and regulations governing short-term rentals.

Familiarize yourself with these regulations to ensure you operate within the legal boundaries and avoid any potential penalties or conflicts.

In addition to location and regulations, effective management is key to a successful Airbnb investment. Managing your property requires attention to detail, timely communication with guests, and ensuring the property is well-maintained.

You may choose to handle all aspects of management yourself or enlist the services of a professional property management company to streamline operations and enhance the guest experience.

Types of Rentals

When it comes to buying an Airbnb property, it’s crucial to consider the different categories of rentals available. Let’s delve into the three primary categories: luxury vacation rentals, unique/exotic rentals, and affordable rentals.

Luxury Vacation Rentals

Luxury vacation rentals are the epitome of elegance and comfort, offering an unmatched experience for travelers seeking high-end accommodations. These properties, which could range from beachfront villas to serene lake houses, often come with a hefty price tag. Let’s weigh the pros and cons of investing in luxury vacation rentals:

The promise of high returns

Luxury vacation rentals can be a goldmine, thanks to their premium rental rates. With the potential to rake in thousands of dollars per night, these properties can be a lucrative investment.

The seasonal nature and potential impact of economic downturns

Luxury vacation rentals can be a double-edged sword. While they can be highly profitable during peak seasons, they can also be affected by off-peak periods and economic recessions, which can impact occupancy and rental rates.

Financing options and contingency plans

Financing luxury vacation rentals can be a complex process, but there are options available based on the property’s income potential. It’s also crucial to have a Plan B in case of unexpected circumstances, such as a drop in bookings or increased competition.

PROS

- High potential for returns due to premium rental rates.

- Attracts high-end clientele, potentially leading to repeat bookings.

- Can offer unique, upscale experiences that stand out in the market.

CONS

- Susceptible to seasonality and economic downturns, which can affect occupancy and rental rates.

- Higher initial investment and maintenance costs.

- Financing can be more complex and challenging.

Tips

Location is key

Choose locations that are a magnet for vacationers, such as popular tourist destinations, areas near major events, or places with stunning natural landscapes.

Know the local laws

Get acquainted with local laws and regulations regarding short-term rentals, as some areas may have specific requirements or restrictions.

Do your homework

Conduct thorough market research to understand the rental rates and demand in your chosen location. Use tools like heat map analysis to identify popular areas and potential profitability.

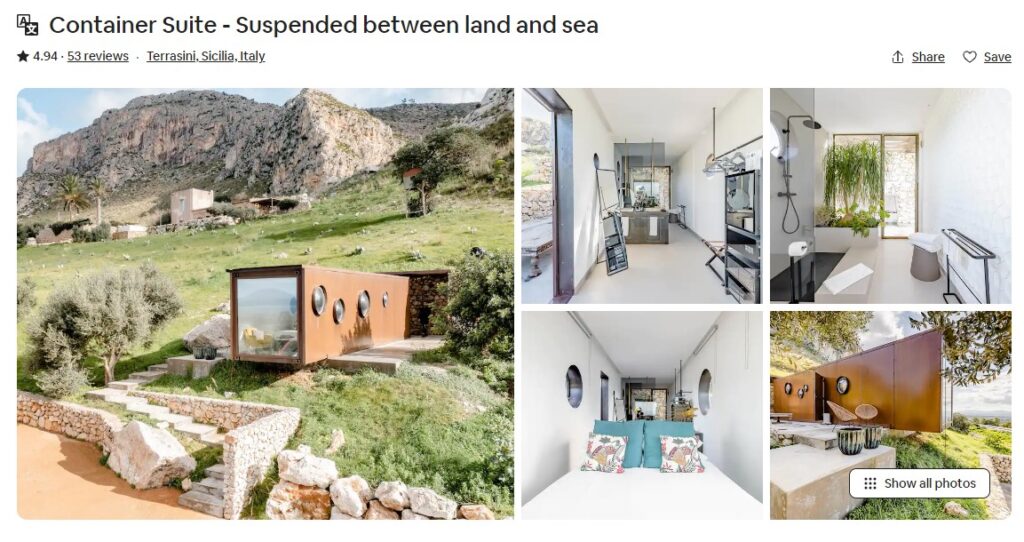

Unique and Exotic Rentals

Unique and exotic rentals offer a one-of-a-kind experience, ranging from tree houses and houseboats to glamping sites and unconventional accommodations. Investing in these types of rentals can be an exciting venture, but it’s important to consider the following pros and cons:

High returns with lower investment costs

Unique and exotic rentals often require less upfront investment compared to luxury vacation rentals. With a creative marketing strategy and attractive pricing, these properties can yield significant returns.

Susceptibility to economic downturns and seasonality

Unique and exotic rentals can be vulnerable to economic downturns. During recessions or periods of reduced disposable income, travelers may be less inclined to book unconventional accommodations.

Limited financing options and smaller resale market

Financing unique rentals can be challenging due to their non-traditional nature. Also, when it comes to resale, the market may be smaller as fewer buyers may be interested in such properties.

Exotic rentals, while offering high returns, can be riskier due to their reliance on discretionary spending and limited financing options.

Tim Hubbard

PROS

- High potential for returns with lower initial investment costs.

- Offers a unique experience, attracting niche markets.

- Can stand out in a crowded market due to their distinctive nature.

CONS

- Vulnerable to economic downturns and discretionary spending.

- Limited financing options due to their non-traditional nature.

- Smaller market for resale, potentially making it harder to sell the property.

Tips

Identify your niche

Research and identify specific niches or unique experiences that are in demand. Catering to a specific audience can help maximize bookings and occupancy rates.

Follow the rules

Ensure compliance with local regulations and zoning restrictions to avoid any legal issues. Some areas may have specific rules regarding unconventional rentals.

Use analytics to your advantage

Use Airbnb analytics tools or platforms like Airbtics to evaluate the profitability and demand for unique and exotic rentals in your target location. Analyze historical data, occupancy rates, and guest reviews to make informed decisions.

Affordable Rentals

Affordable rentals cater to budget-conscious travelers who seek comfortable accommodations without breaking the bank. These properties can range from apartments and condos to modest houses. Let’s explore the pros and cons of investing in affordable rentals:

Steady demand and potential for long-term tenancy

Affordable rentals often attract tenants who are looking for extended stays or long-term leases. This can provide a steady source of income and reduce the need for frequent turnover.

Lower returns compared to luxury and unique rentals

While affordable rentals offer stability, they may generate lower returns compared to luxury or unique rentals that command higher rental rates.

Affordable rentals may have lower returns compared to luxury properties, but they offer stability and a broader market.

Tim Hubbard

Easier financing options and broader resale market

Financing options for affordable rentals are generally more accessible due to their lower purchase prices. Additionally, the market for resale is broader, as there is typically more demand for affordable properties.

Affordable rentals in urban or suburban areas have the best financing options and can be the safest investment.

Tim Hubbard

PROS

- Steady demand and potential for long-term tenancy.

- Easier financing options due to lower purchase prices.

- Broader market for resale, potentially making it easier to sell the property.

CONS

- Lower returns compared to luxury and unique rentals.

- May require more frequent maintenance due to higher turnover.

- Market can be competitive, especially in popular locations.

Tips

Location is key

Choose locations that are a magnet for vacationers, such as popular tourist destinations, areas near major events, or places with stunning natural landscapes.

Get to know the area

Analyze the long-term rental potential of the area by considering factors such as proximity to schools, universities, and employment centers. Additionally, assess the stability of the local rental market to ensure consistent occupancy rates.

Do your homework

Calculate the operating expenses associated with the property, including mortgage payments, property taxes, insurance, and maintenance costs. Estimate the cash flow projections to determine the potential profitability of the investment.

Factors to Consider when Buying an Airbnb Property

Investing in an Airbnb property requires careful consideration of various factors to ensure a successful venture. Let’s delve into the key aspects you should evaluate when buying an Airbnb property.

Understanding local regulations and compliance requirements

When it comes to operating an Airbnb property, it’s essential to understand and comply with local regulations. Zoning laws, permit requirements, and homeowner association rules can vary from one area to another.

According to Investopedia, several cities, such as Paris, Barcelona, Amsterdam, Miami, and Santa Monica, have strict regulations regarding Airbnb rentals. These policies are often implemented to protect local residents and address concerns about displacement, housing shortages, and the impact on neighborhoods.

Regulations vary by city, and it’s essential for hosts to check with both Airbnb and their local statutes before listing a property. Some cities, like Berlin and London, have loosened their requirements, allowing short-term rentals with certain limitations.

The reasons for Airbnb restrictions include tax concerns, competition with traditional lodging options, and issues related to safety and community disruption.

So familiarize yourself with these regulations to ensure you’re legally permitted to operate a short-term rental. Compliance not only protects you from potential legal issues but also provides peace of mind for a smooth and trouble-free operation.

Evaluating potential profitability and returns

Before you dive into the investment pool, it’s paramount to assess the potential profitability of the property. Take into account the location and its allure to potential guests. Is the property nestled in a sought-after neighborhood or a stone’s throw away from popular attractions?

Moreover, scrutinize the rental demand in the vicinity. Utilize tools like AirDNA or Mashvisor to gain valuable insights into rental rates and market trends.

Balance these figures with your anticipated expenses, which include mortgage payments, property taxes, utilities, maintenance costs, and management fees.

This comprehensive analysis will aid you in determining the potential return on investment and ensure the property aligns with your financial aspirations.

Exploring Financing Options and Securing Capital

Buying an Airbnb property requires financial considerations. Explore different financing options available to you, such as:

Traditional Mortgages

Traditional mortgages are a common financing option for buying properties. These loans are typically repaid over a long period (15 to 30 years) and require a down payment, which usually ranges from 5% to 20% of the property’s price. Interest rates can be fixed or variable, and the terms and conditions can vary widely among lenders.

Specialized Loans for Short-Term Rentals

Some lenders offer specialized loans designed specifically for short-term rental properties. These loans may have different qualification requirements and terms compared to traditional mortgages. For instance, the lender might consider the potential rental income from the property when determining your eligibility.

Home Equity Loans or Lines of Credit

If you already own a home or another property, you might consider a home equity loan or a home equity line of credit (HELOC). These options allow you to borrow against the equity you’ve built up in your property. They can provide a source of funds for a down payment or even the entire purchase price of a new property.

With short-term rentals known for their higher income potential compared to long-term rentals, securing the right financing can be a game-changer in maximizing your returns.

Managing the property and considering property management services

Managing an Airbnb property involves various responsibilities, from guest communication to maintenance and cleaning. Determine your level of involvement and decide whether you’ll handle these tasks yourself or hire a property management company.

Hiring professionals, like a virtual assistant, can save you time and effort while ensuring a seamless experience for your guests.

Remember, positive reviews and guest satisfaction are crucial for long-term success.

Don’t let poor management crush your returns.

Follow my 3-step mandatory reservation checklist to ensure your property is prepared to maximize returns.

Marketing and branding the property for maximum exposure

Did you know that marketing and branding can significantly impact the success of your Airbnb listing? It’s especially important considering the diverse range of renters in the United States.

According to a study by the Joint Center for Housing Studies of Harvard University, renters come from various age groups, races, ethnicities, incomes, and family types. This means that you have the opportunity to attract renters who are looking for flexibility and affordability, particularly among younger adults under the age of 35, who represent a significant portion of the renter population.

To effectively capture the attention of these renters, you need to implement robust marketing strategies and establish a compelling brand for your Airbnb listing.

Since renters have a median age of 42, which is considerably younger than homeowners, it’s crucial to align your marketing efforts with the preferences and interests of this demographic.

Using social media platforms, creating engaging content, and showcasing appealing visuals can help you establish a strong brand identity that resonates with younger renters seeking unique and enjoyable experiences.

Moreover, it’s essential to tailor your marketing approach to cater to the changing needs of different age groups. As individuals progress through various life stages, their housing preferences evolve.

Older renters, especially those aged 75 and above, may prioritize convenience and supportive services. Emphasizing features like accessibility, proximity to amenities, and available assistance can be highly effective in targeting this specific segment.

Craft an appealing listing with high-quality photos that showcase the unique features and amenities of your property.

Write accurate and enticing descriptions that capture the attention of potential guests. Don’t forget to leverage online platforms, social media channels, and SEO techniques to increase your property’s visibility.

Consider using tools like AirDNA to optimize your pricing strategy and stay competitive in the market.

Analyzing risks and rewards of Airbnb investments

Just like any investment venture, Airbnb properties come with their own set of risks and rewards. It’s crucial to understand these factors to make an informed decision that aligns with your investment goals and risk tolerance.

Risks

Legal and Regulatory Challenges

The legal landscape for Airbnb and short-term rentals can be quite complex and varies significantly from one location to another.

For instance, cities like New York and San Francisco have imposed strict regulations on short-term rentals, limiting the number of days a property can be rented out per year and requiring hosts to register with the city. Non-compliance with these regulations can result in hefty fines – ranging from $1,000 to $5,000.

In contrast, other cities like Austin, Texas, or Nashville, Tennessee, are more lenient, making them popular destinations for Airbnb hosts.

Before investing in an Airbnb property, it’s crucial to understand the local laws and regulations. This includes zoning laws, licensing requirements, and restrictions on the number of rental days per year. For example, in Paris, the maximum number of rental days per year is 120, while in London, it’s 90 days. Non-compliance can lead to fines and legal issues.

In 2020, for instance, the city of Paris fined Airbnb €8 million for listing unregistered apartments.

Market Fluctuations

The demand for short-term rentals can fluctuate due to various factors. Seasonal trends can significantly impact demand, with properties in tourist destinations seeing a surge during peak travel seasons. However, during off-peak periods, these properties may see lower occupancy rates.

Economic conditions also play a significant role. During economic downturns, people tend to cut back on travel, which can lead to a decrease in bookings. For instance, during the COVID-19 pandemic, many Airbnb hosts saw a significant drop in bookings.

According to a report by AirDNA, global Airbnb bookings dropped by 72% in April 2020 compared to the previous year.

In Beijing, revenue declined by 22% after the onset of Covid-19. Similarly, other cities like Tokyo and Seoul saw significant decreases in revenue in the early months of 2020.

Property Management

Managing an Airbnb property involves various responsibilities, from guest communication and handling bookings to cleaning and maintenance. These tasks can be time-consuming, especially if you have multiple properties or if your property is frequently booked.

Risks

Income Potential

Buying an Airbnb property can be a lucrative venture due to the high income potential. Short-term rentals often command higher rates than traditional long-term rentals.

For instance, according to a report by Earnest, Airbnb hosts make nearly three times as much as other workers in the gig economy, with an average monthly income of $924.

If your property is located in a popular tourist destination or a city with high demand for short-term rentals, you can earn even more.

Flexibility

Owning an Airbnb property offers a great deal of flexibility. Unlike traditional rental properties, where the property is typically leased out for extended periods, Airbnb allows you to block off dates for personal use. This makes it an excellent option if you’re investing in a vacation home that you also want to use.

You could block off a few weeks during the summer for a family vacation, or use the property as a retreat during the off-peak season.

Property Appreciation

Real estate is often considered a good investment because properties can appreciate in value over time. According to the U.S. Federal Housing Finance Agency, U.S. house prices have increased by an average of 3.4% per year from 1991 to 2020.

When you are buying an Airbnb property, not only do you earn income from rentals, but you also stand to gain from property appreciation. When you decide to sell the property, you could make a substantial profit. For example, if you bought a property for $200,000 and it appreciates by 3% per year, in 10 years, the property would be worth over $268,000.

However, it’s important to note that property appreciation is not guaranteed and can be influenced by various factors, including the overall health of the economy, local real estate market conditions, and the condition and location of the property.

Long-term outlook and sustainability of the Airbnb business

Consider the long-term outlook of the Airbnb market in your desired location. Analyze tourism trends, economic stability, and the overall sustainability of the short-term rental industry. The projected growth of the vacation rental market indicates continued potential and opportunities.

Here are some factors to consider:

Infrastructure Development

The development of infrastructure, such as transportation, utilities, and amenities, can significantly impact the attractiveness of your location to potential guests. For instance, properties in areas with well-developed public transportation systems or close to major highways may be more appealing to travelers.

Local Attractions

The presence of local attractions, such as tourist sites, natural beauty, cultural events, or major businesses, can drive demand for short-term rentals. For example, properties in Orlando, Florida, benefit from the city’s numerous theme parks, while rentals in cities like New York or San Francisco may attract visitors due to their rich cultural offerings and business opportunities.

Accessibility

The ease of reaching your location can also affect its long-term sustainability. Properties that are easily accessible, whether by car, public transportation, or flights, can attract more guests.

Final thoughts on Buying An Airbnb

Buying an Airbnb property can be a rewarding venture, but it requires careful planning, thorough research, and strategic decision-making. Whether you’re drawn to the allure of luxury rentals, the uniqueness of exotic accommodations, or the stability of affordable rentals, there’s a niche in the Airbnb market that can align with your investment goals.

The key to a successful Airbnb investment lies in understanding local regulations, assessing potential profitability, securing the right financing, effectively managing the property, and marketing it to the right audience.