Ever wondered, “How does QuickBooks Online work?” Well, you’re in for a treat! QuickBooks Online (QBO) is a game-changer for businesses, especially those in the short-term rental sector. Dive in with me as we unravel the magic behind this software.

The Importance of Bookkeeping for STR Owners

In the bustling world of short-term rentals (STRs), where transactions happen at the speed of light, bookkeeping is the unsung hero. While 40% of business owners might dread it, the importance of bookkeeping in the STR industry cannot be overstated.

Why is it so crucial?

Volume of Transactions

Unlike traditional rentals where you have a single monthly transaction, STRs can have multiple transactions in a day. This means a higher volume of financial data to manage.

Dynamic Pricing

STRs often employ dynamic pricing, adjusting rates based on demand, season, or local events. Proper bookkeeping ensures you’re capturing these fluctuations and understanding their impact on profitability.

Operational Expenses

From cleaning fees to restocking amenities, STRs have unique operational expenses that need meticulous tracking.

Regulatory Compliance

Many cities have regulations around STRs, including tax collection. Proper bookkeeping ensures you’re always in compliance and not leaving money on the table.

Remember the Excel days? They were like trying to use a bicycle for a cross-country trip. Functional, but not efficient. Today’s tools, like QuickBooks Online, are the equivalent of a high-speed train, getting you to your destination faster and more comfortably.

Setting Up QuickBooks Online

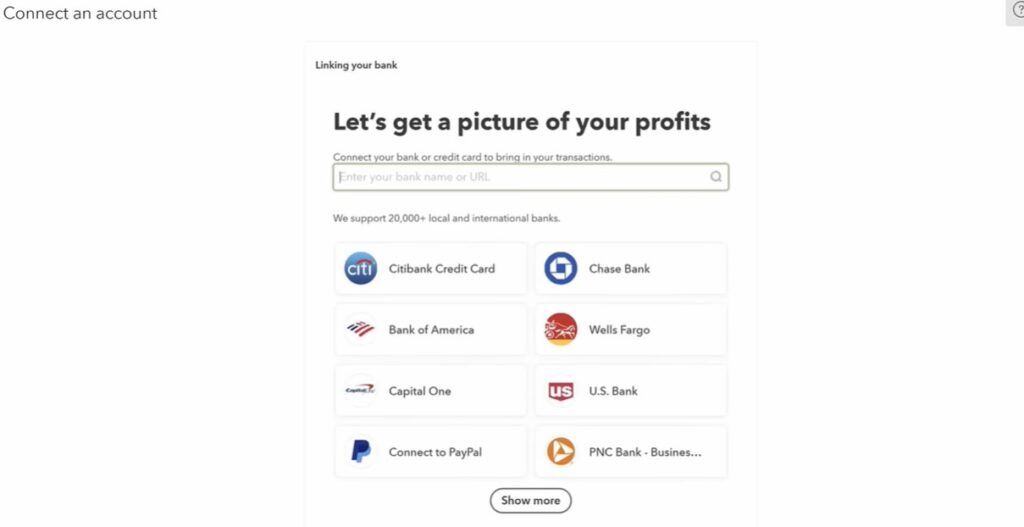

1. Linking Accounts

Think of QBO as the central nervous system of your STR business’s financial operations. By linking your business accounts, you’re not just automating data entry; you’re setting up a real-time financial dashboard.

Every transaction, whether it’s a guest payment or a utility bill, gets automatically pulled into QBO. And about security? QBO employs state-of-the-art encryption, ensuring your financial data is as secure as gold in Fort Knox.

2. Organizing Transactions

The beauty of QBO lies in its organizational prowess. With the “class” feature, you can categorize transactions down to individual properties. This is especially handy for STR owners with multiple properties.

TIP

If you're using another property management software, you'll find that integrating QBO's class feature is a seamless way to keep your finances organized across platforms.

Want to know how your beachfront condo is performing compared to your downtown apartment? QBO has you covered.

And with its auto-recognition feature, recurring transactions are categorized automatically, saving you precious time.

By having all of your accounts linked directly into QuickBooks, every transaction that you make goes into that profile. You can simply mark transactions as personal if they're not related to the business, or use the class feature to separate them by property.

Tim Hubbard

3. Contractor Payments and 1099s

STRs often involve third-party services, be it cleaning, maintenance, or property management. QBO streamlines the process of managing contractor payments.

The platform not only helps you track payments but also ensures compliance with tax regulations. The W-9 and 1099 processes, often a headache for many, become a breeze with QBO.

QuickBooks has a tool integrated for contractor payments. Anyone that you pay over $600 a year, you’re supposed to give them a 1099 at the end of the year. They make it really easy to track your contractors.

Tim Hubbard

4. Time Tracking Integration

For those STR owners who employ hourly workers, like housekeepers or maintenance staff, QBO’s time tracker is a godsend. It helps you track hours and integrate payroll with your overall financials, ensuring a holistic view of your business’s financial health.

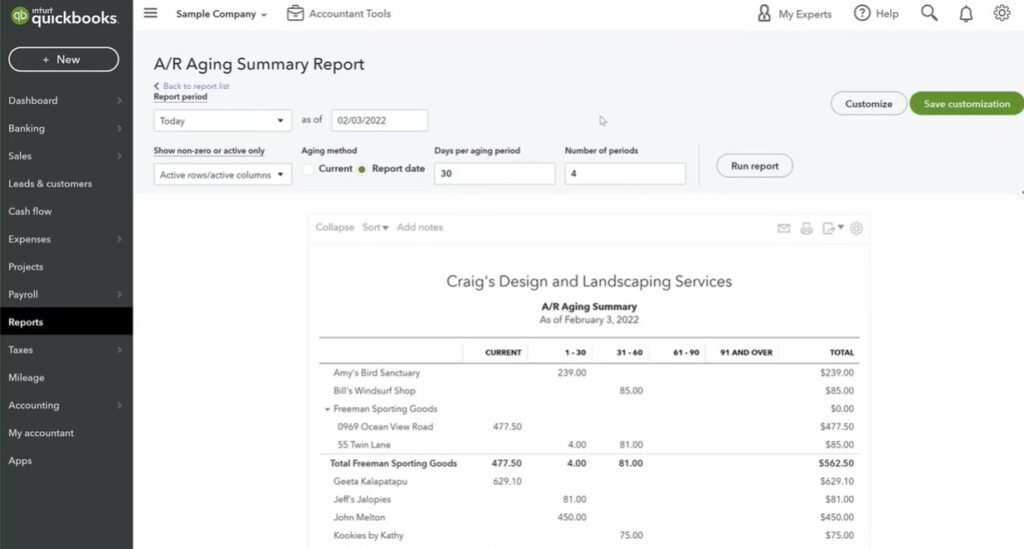

5. Generating Reports

In the STR world, understanding financial performance is key to growth. With QBO, you can generate a plethora of reports, from profit and loss statements to balance sheets. Whether you’re seeking financing or just want to understand cash flow, QBO’s reporting tools are invaluable.

And with advanced search features, sifting through transactions is as easy as typing in a keyword.

You can run reports really easily with QuickBooks. So if you’re shopping loans and a lender or mortgage broker is asking you for a year-to-date statement or how last year did, you can easily do so.

Tim Hubbard

6. Sharing and Collaboration

The world of STRs is collaborative. You might have a property manager in one city, a CPA in another, and a business partner in a third.

QBO’s sharing features ensure that all stakeholders have access to the financial data they need. Plus with robust user permissions, you control who sees what, ensuring data integrity and confidentiality.

Get 30% off for 6 months by using the link below!

Personal vs. Business Accounting

Life isn’t always black and white, and sometimes, the lines between personal and business finances can blur. But with QBO, you can keep both worlds separate yet integrated. By classifying transactions, you ensure clarity and precision, making financial management a breeze.

Why is this distinction so vital?

Clear Financial Objectives

On one hand, your personal goals might be about saving for a new car or planning a family vacation. On the other, your business ambitions could revolve around scaling up operations or launching a new product line. By keeping these finances separate, you can chart a clear course for both.

Tax Nuances

Merging personal and business finances can muddy the tax waters. Remember, while business expenses often offer tax deductions, personal ones don’t. A clear demarcation ensures you leverage all potential tax advantages.

Creditworthiness

Should your business ever require loans or credit extensions, lenders will look for transparent business financial records. They prefer clarity over the cacophony of mixed transactions.

Simplicity and Sanity

There’s undeniable ease in knowing that your personal purchases aren’t denting your business accounts and vice versa. It allows for clear personal choices and strategic business decisions.

With QBO, achieving this balance becomes intuitive. Its user-friendly platform lets you categorize transactions with precision. Imagine having two distinct ledgers under one account. Every transaction, whether it’s a personal dinner out or an investment in business equipment, is accurately logged.

QBO’s advanced reporting features ensure that you get a clear picture whenever you need it. Be it an overview of your personal expenditures or a deep dive into your business revenues, it’s all available, neat and tidy.

Final thoughts

The world of finance is evolving, and QBO is leading the charge. With its continuous improvements and upgrades, it’s no wonder that it’s the go-to for many businesses. So, if you’re a short-term rental owner looking to streamline your financial processes, why not give QBO a shot? After all, in the world of business, efficiency is the name of the game.

Listen to this podcast episode on “The Easiest Way to Keep Track of Your Rental Income and Expenses”