When you speak of economics, the law of supply and demand will surely surface one way or another. That context is very elementary. If the demand is higher than the supply, the prices of commodities will most likely suffer. It has been a proven formula that shows how these two are never without the other.

Real estate is one of the industries that openly adopts the law of supply and demand. Perhaps that is one of the features of real estate investing that makes it attractive. This kind of investment offers and generates a passive source of income, and though it is volatile, it presents unlimited opportunities.

In today’s market, the number of renters supersedes the inventory of homes.

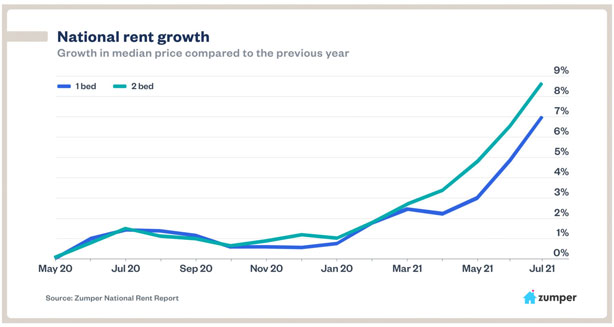

In July, the steep spike in rent that has come to characterize 2021 continued, climbing 7% year over year for one-bedroom apartments and a shocking 8.7% for two-bedroom flats, according to Zumper’s National Rent Index, a national rental listing platform.

Many Millenials are empty nesters, going through transitions like divorce or death of a partner or starting their own families hoping to have their own homes. However, homeownership is still way out of their league. Some have pending student loans to pay off or are just starting a new journey in their professional career. Renting is the only viable alternative for them to experience living independently.

Since most of this demographic is looking into the rental housing market, the demand has increased exponentially, putting too much weight on the supply. As a result of this transition, the supply and demand mismatch will widen even more. The rent skyrockets, the supply remains low, and the demand unwavering.

It is undeniably true that landlords grow rich while they sleep because they get to put a higher price tag on their properties whenever the supply hits rock bottom. Hence, more real estate investors venture into multi-family residential properties catering to a more lucrative market.

When the pandemic hit, the decline in homeownership paved for rental housing to reach its highest potential. Building new houses is not the sector’s priority since there is a bigger problem to face on top of the operational hindrances like the unreasonable time spent in zoning alone and the outrageous cost of materials. Even if they can build, entry-level homes do not present a profitable platform for investors. Real estate investors won’t settle and dwell on a situation where their investment would sleep. They will always look for opportunities even amidst a pandemic.

Nowadays, the percentage of homeownership drops because more are leaning towards renting. Some move from one place to another depending on the weather, health, and economic conditions, notwithstanding the current situation the planet is encountering. Some areas offer a more conducive means of employment, tax exemptions, and the overall cost of living.

As an investor, you need to be keen on your observation. It’s okay to test the waters to see if it will flow smoothly in the direction you wanted or remain stagnant. Since operating a short-term rental business falls under the rental housing market category, it is safe to say that the flow won’t be an issue given the current market situation.

Since the pandemic opened doors to employees to work from home, many city dwellers moved to the suburbs and began renting there. Being on the investor’s side, you can predict a stable and sound investment. Choose a location where the demand is high and the supply is low. That is your leverage. That is where you can put the flag down. There’s a good chance that you’ll receive positive responses because you’ll turn out to be an addition to the supply. You can raise your rent as reasonably and realistically high as you want. If the area yields good profit, the appreciation value increases too, meaning your investment is up for the long haul.

Finding the ideal real estate market is critical whether you’re buying your first or fourth buy and hold property. These variables include everything from local economic indicators to vacancy rates and demographic trends. Looking at the year’s best rental markets is a great place to start. These cities, however, are only the beginning. Pay attention to the characteristics that define these new real estate markets, and let them lead you in your search for the optimal place for your investment.

While renters wonder if prices will decline, it appears that they are about to surge much higher. Rental deals at the time of the pandemic are no longer available. Prices are skyrocketing, and new research indicates that they will continue to soar. Severe shortages, increased demand, high property prices, and enormous wealth for those who can rent characterize the rental property market in the United States.

Assets and properties aren’t profitable for real estate investors if they only rely on the normative increase. Now more than ever is the best time to purchase a property, convert it into a short-term rental since that will provide you with the highest value over time, which would roughly help you break even.