YOU’RE INVITED INTO THE

Rested Investor

Club House

YOU’RE INVITED INTO THE

Rested Investor

Club House

You Don’t Have To Settle For Low Returns On Your Real Estate Investments:

The problem is, following the traditional model with long-term tenants didn’t provide a lot of profitability to reinvest. I still had to keep my day job, which made it harder to travel.

But when I converted my first unit to a short-term rental, I started making between 3x – 8x the returns of my LTRs! So I started converting more of my long-term units into short-term rentals and before I knew it, I was making $200k from the same property that used to generate $60k.

That’s what allowed me to quit my job and go full-time on STRs, earning in USD and spending in Colombian Pesos while living a good life in Medellin, Colombia.

I’ve since designed my whole portfolio specific to the properties and units that can maximize returns so I can scale safely. I’ve got it down to a formula for acquiring, furnishing, and automating STRs so I can sleep easy at night knowing my money is working hard so I don’t necessarily have to.

That’s how I scaled up to 68 units across 3 states, with property in 3 countries, and I now have the time and financial freedom to live anywhere.

And what I’ve learned in the last 10 years in real estate is that there are 2 types of investors...

The Rookie Investor

A rookie investor will see the money being made on Airbnb and think they can replicate the earning potential with any property. So they find a property they can afford in a tourist-enough destination, make the place beautiful (maybe even theme it) so they can charge more, and hope for the best when they list their rental.

Occupancy is subject to seasonality

Limited types of travelers

They attract shorter stays, faster turnover, and more cleaning fees

They have no backup plans if regulation changes or if bookings slow

This is why a rookie investor has a hard time scaling

because their properties are more risk and more work.

The Rested Investor

A rested investor doesn’t get overly romantic about the location or decor because the property is an investment designed for higher, more secure returns. They know how to run the numbers to find profitable properties that are profitable as a long-term rental, and at least 3x more profitable as a short-term rental. They prefer to buy property in more affordable submarkets that serve more types of travelers so they’re not subject to seasonal occupancy, and furnished to attract professionals who stay longer.

Occupancy is consistent year round

Bigger market of traveler types

Attracts longer stays for less work and lower cleaning fees

If bookings slow or regulation changes, they can stay afloat with a long-term tenant

This is how a Rested Investor scales safely by maximizing returns and minimizing risk.

“ I replaced my income

in 6 months. ”

“Almost a year ago I was just beginning my search into STRs, and Tim was living my dream.

In less than a year, I’ve now purchased 4 STRs and converted one of my LTRs in Florida into an STR (I still have 5 LTRs in Florida).

The income from the STRs has been much better than expected, and within 6 months I replaced my six-figure income!

I’m now planning to leave my W2 and we’re making plans to move to Colombia. STRs have changed my life and are making my dreams come closer to reality.”

- Cale Delaney

Now Accepting New Members In

The Rested Investor Club House

And Living Better By Investing In High-Return Properties

Monthly Mastermind Meetups

- Vote on the topics you want Tim to cover so you have guidance along your STR journey

- Access to guest speakers in the real estate and STR world that Tim has connections to from years of conferences, coaches, and podcasting

- Get your questions answered in the Q&A section of the call

- Hear what Tim’s doing behind-the-scenes as he scales his portfolio in different markets

- Searchable video content

- Learn new tips and insights in each section of the library, organized into Acquisition, Attraction, Furnishing, Automation, Tools and Technology, and Past Mastermind Recordings

- Transcription allows you to skim the contents of the video without having to watch full videos

- Progress tracker so you know what content you’ve seen and what you haven’t

- New videos uploaded every week

Rest Methods Content Library

Tim’s Rolodex of Resources and Recommendations

- Templates you can customize for your Guest Communication Scripts, House Rules, Job Descriptions, and Lease Agreements

- Checklists to systemize your processes like Due Diligence, Furnishing, and House Cleaning

- Rolodex of contacts for Private Lenders, Insurance Brokers, and Property Managers

- The Tech Stack that Tim uses to manage all the properties in MidTown Stays

Share your wins, resources, and questions inside the R.I.C.H. Facebook community where you can get access to Tim and fellow Rested Investors as you start or scale your portfolio.

- Post your questions into the Facebook channels for Tim and fellow Rested Investors to help you navigate your STR journey

- Share wins and milestones to inspire and motivate each other

- Inspire and gain inspiration from sharing your travels and staycations in the Rich Life channel

- Get reports and updates sent into the community as Tim researches industry news for his own business

Private Facebook Community

Immediate Access to Past Mastermind Recordings

- How To Find Profitable Properties - Interactive Tutorial

- Financing Fundamentals For Acquiring New Properties

- How To Price Your Properties For Maximum Revenue

- Listing Profile Reviews To Maximize Occupancy

- Essential and Efficient Home Automations and Furnishing Tips

- Short-Term vs. Long-Term Stays For Best Returns

- How To Replace Yourself For $3-$6/hr

- How To Properly Insure Your STRs

- STR Tax Tips With My Accountant

“ In less than 2 years I have 16 Short-Term Rentals that run themselves. ”

- Steve Coughlin

When You Join

The Rested Investor Club House

Here's what you get

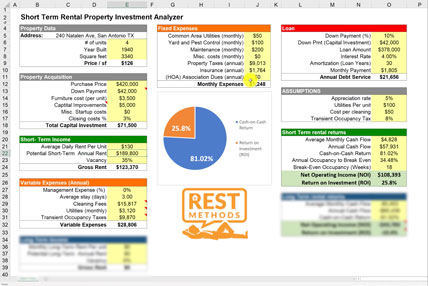

My Profitable Property Calculator

01

Learn how to “run the numbers” so you can see if it will be profitable as an LTR (to minimize risks) and at least 3x more profitable as an STR.

This custom spreadsheet I created from my commercial investment broker days has helped me build my portfolio with high-return properties so I’m not gambling with my money.

You’ll become a confident investor with this calculator and the training videos to show you how to use it to analyze live deals.

*This Profitable Property Calculator is only available in the R.I.C.H. Club and my STR Playbook.

GET MY 2023 LIST OF TOP 34 CITIES THAT MEET MY STR CRITERIA FOR A PROFITABLE MARKET, AND THE TOP 11 CITIES TO AVOID RIGHT NOW.

Limit the research you have to do when finding profitable properties by sorting through my top city list, organized by AirDNA recommendations and my own personal suggestions.

*This list is exclusive to the R.I.C.H. Club.

My Top

Cities List

02

The Replace Yourself Challenge

03

GET IMMEDIATE ACCESS TODAY

JOIN THE CLUB HOUSE

Get access to thousands of dollars worth of value, and tons of golden nuggets to help you maximize your returns and minimize risk along your STR journey so you can Live Good and Rest Easy!

Join Quarterly

NO RISK, CANCEL ANYTIME!- Get immediate access to everything above for only…

$297 TODAY

Join Annual

AND SAVE $765 PER YEAR!- Get immediate access to everything above AND get access to the *STR Playbook for FREE!

Join Monthly

No Risk, Cancel Anytime!

Get immediate access to everything above for only…

$147.00

Join Annual

And Save $765 Per Year!

Get immediate access to everything above AND get access to the *STR Playbook for FREE!

$999.00

Go Annual And You’ll Also Get…

FREE! FREE! FREE!

*My 7-Figure STR Playbook

- Module 1: Acquisition

- How to identify hot sub-markets

- Property acquisition, regulations, and due diligence

- Property analysis case studies

- How to furnish your listing to attract higher quality guests

- Module 2: Attraction

- Essential software applications

- Listing setup case study with numbers

- Listing review

- Guest reservations

- Module 3: Automation

- Management and housekeeping options

- Finding maintenance help

- Building your virtual team

- How to scale

- Case study with numbers

- Bonus Resources

- Profitable Property Calculator

- Software Recommendations

- Housecleaning Checklist

- Housekeeper Hiring Template

- Lease Arbitrage Template

- Behind-The-Scenes of My Properties

“ I’ve acquired 11 new units since meeting Tim ”

“A lot has changed since I met Tim.

I had two units successfully running on Airbnb.

I’ve now expanded into two new markets and acquired eleven new units – all of which I am in the process of turning into short term rentals!

Tim gives you the tools and confidence you need to scale your business. Growth can be scary and painful at times, but Tim’s experience, knowledge, and easy going attitude helped me

through it. I realized I didn’t have to reinvent the wheel – Tim has already done this work and gladly provides you with the resources and guidance you need to take that next step. From finding the right markets for me, to identifying properties that worked best for my goals, and then converting them into furnished, short term units, Tim’s advice was invaluable.

Whether you’re just starting out as a short term rental host, or looking to scale your business, Tim’s course has the information and direction you need. I cannot recommend it enough!”

- Stephanie Y

“Live Better, Rest Easy”

– Tim Hubbard

Frequently Asked Questions

The clubhouse is open to anyone who is interested in real estate investing, whether they have a property or not. We have some members who are just starting to explore this world, others with Long-Term Rentals they’re thinking of converting into Short-Term Rentals, and others who have anywhere between 1 – 30+ STRs.

As long as you have a desire to learn about investing in STRs in a way that maximizes your returns and minimizes risk, then the Rested Investor Club House is for you!

I don’t want to create financial stress for you, I want to help you save money and get the best returns so you can live better and rest easy.

If you no longer find value in the R.I.C.H. Club, or you need to cancel for whatever reason, just send us a message and we’ll help you out.

However, if you decide to join annually then we do not offer refunds on unused membership time because of the $697 you saved on the STR Playbook that comes with annual access.

Outside of our private monthly calls, the majority of the content you’ll find inside the content library is already on YouTube for you to binge for free.

However, the platform we use to host the content is designed to be keyword searchable so you can instantly find all mentions of “guidebook” or “house rules” for example without having to watch full videos to find what you’re looking for.

Plus you’ll have access to me and other Rested Investors to get your questions answered, as well as templates, trainings, checklists, and resources that aren’t available anywhere else online.

You might hear about the number of hosts that are popping up every single day to take a piece of the STR pie, but even with the crazy amount of supply, the founder of Airbnb still says they need more hosts to meet demand… and that’s just Airbnb! We know that many short-term rentals can thrive on other platforms like VRBO, HomeAway, and direct booking sites.

I don’t believe STRs are ever going away as they’ve become the new way of travel. People are checking into traditional hotels less often, while we’re seeing 6 people checking into an Airbnb every second!

Plus a lot of people can’t afford to buy a house right now, so we have an influx of renters who don’t necessarily want to sign annual contracts in one place when they can live and work from anywhere.

While it might be tough to buy beachfront vacation rentals, the type of properties I prefer to invest in will always have utility as an STR (or LTR if need be).

I think now is the perfect time to get into the STR game!

So if you’re ready to learn how to invest in STRs like a Rested Investor, smash that button below and join us inside the R.I.C.H. Club…

He had a plan, and it’s EXACTLY what I needed if I was going to stay with this. It had gotten to the point that I was either going to find a yearly renter or I was going to sell the house, because the single handed management of the home was absolutely ruining me! Coming from a strong background in customer service, and real estate knowledge- managing a STR is a whole different ball game.

Tim’s team was an absolute dream to stumble upon, and thanks to all their knowledge, quick responses, and excellent customer care of my guests- my bookings, rating and personal peace have all been restored. So much so, that I am even considering another home- which I would have never said before meeting this fabulous and passionate team! “

They have helped us vet guests to avoid the noisy, party crowd who could cause damage to our property and this was probably the single biggest deciding factor for me. Last year, I received numerous noise complaints from our neighbors, our community manager, and a local compliance officer due to unruly and noisy renters. We have not had a SINGLE issue or complaint since working with them.

I am thrilled to be working with such wonderful people. As a short-term rental property owner, I can honestly say that our housekeeping staff and I feel incredibly well supported. I also sleep better at night and have peace of mind. Hire Midtown Stays. You can thank me later 😉 “